Residential property in England is often purchased by overseas residents. Whether you have children studying in the UK or require a base for when you are in London on business, it is comforting to know that buying a UK residential property is relatively straightforward.

You do however need to be aware of Stamp Duty Land Tax (SDLT) which has become more complicated in recent years. The rates for overseas buyers or those who already own a home are different from the amount charged to first home buyers or those replacing their main home.

In this article, I set out what overseas buyers should know about SDLT when purchasing a residential property in England.

What is Stamp Duty Land Tax?

SDLT is a tax that is payable on the purchase of the property. It is a form of property transfer tax and is paid by the buyer, not the seller. The amount of SDLT depends on the purchase price of the property. It is a one-off payment that must be made within 14 days of you completing your purchase.

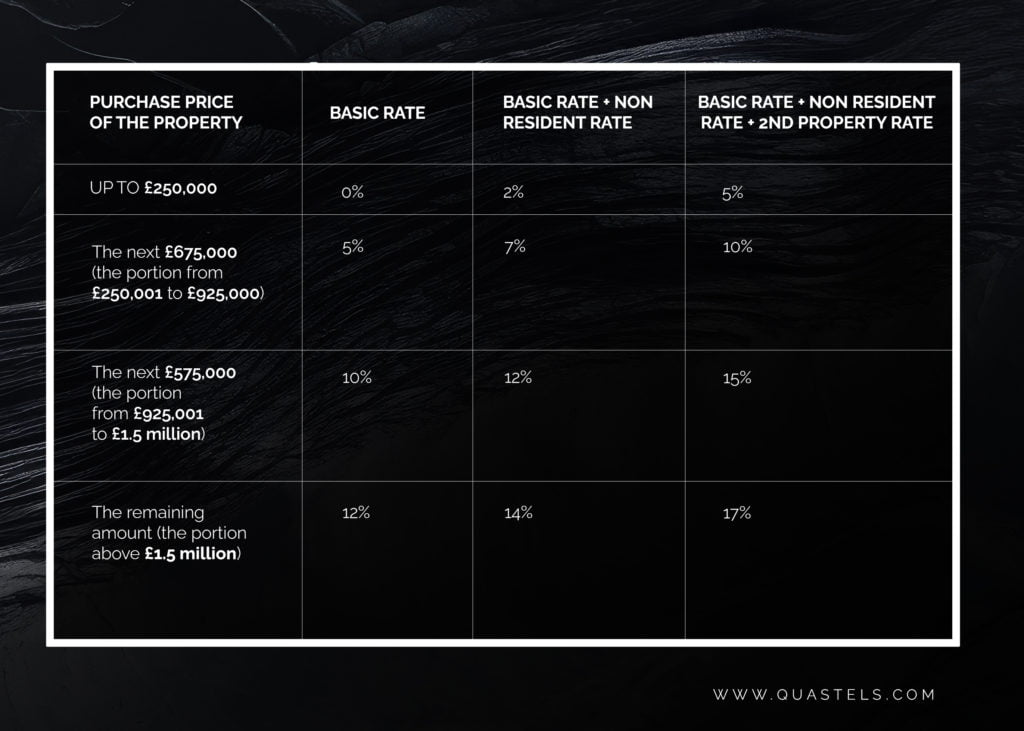

SDLT rates are structured in a tiered fashion, meaning that different portions of the purchase price are taxed at different rates. At the time of writing, the basic SDLT rates for residential property purchases in England are as follows (with the potential additional rates):

What is the SDLT rate for overseas buyers of residential property?

If you are not a UK resident, you must pay an extra 2% tax on the property you purchase. This equates to an extra £20,000 on a £1 million property. The total rate combined with the basic rate of SDLT is shown in the table above

You will be classed as a non-resident if you are living outside the UK 183 days in the year before completion. It makes no difference if you have permanent residency status or a British passport. You will be treated as ‘resident’ for SDLT purposes even if your stay in the UK is temporary, as long as you spent the 183 days in the UK in the immediate year before completion.

For high-net-worth and ultra-high-net-worth individuals, who travel extensively, the 183 days trigger is a crucial factor to keep in mind if you are planning to purchase a property in England.

If you don’t quite make up the 183 days before completion, you can claim a refund of the 2% payment if you spend 183 days out of a period of 365 days in the UK by the time of the first year after your completion date.

I live overseas and own properties in other countries. will I pay more SDLT on my property purchase in England?

Unfortunately, if you own another residential property anywhere in the world you will be charged an extra 3% SDLT. The total rate combined with the basic rate of SDLT and the overseas surcharge is shown in the table above. On top of the £20,000 non-resident increase, your £1 million property will therefore cost an extra £50,000on top of the basic rate.

What if I am selling my main residential property?

The further 3% additional property rate is not intended to penalise people moving home. If you are making the purchased property your principal home, and have already sold your previous main home (or sell it on the same day as the purchase), then the 3% will not be payable.

It often takes time for high-value properties to sell. If you do purchase a second property while your main home is still on the market, then you can apply for a refund on the 3% extra SDLT you paid when you eventually complete the sale, provided that you manage to sell it within 3 years.

I heard that it could be tax advantageous to buy the Property in a company name

If you are purchasing a property for rental income, then there may be income tax advantages in holding the property in a company, but if the property is to be occupied by any family members then SDLT rates are penal.

Purchases by a company which are not for rental purposes are charged at the full rate of 15% on the total purchase price, and, if any of the owners of the company are non-resident, this will increase to a rate of 17%. In addition, an annual SDLT charge, known as ATED, is payable based on the purchase price of the property if not used for rental purposes.

Closing

Purchasing a property in England from overseas can seem daunting, but an experienced Solicitor will be able to guide you through the process and ensure your best interests are protected.

At Quastels there are also expert tax and immigration solicitors to assist you in your investment in the UK.

To discuss any of the points raised in this article, please contact Jonathan Neilan or fill in the form below.

This article is not legal advice.