Latest Posts

UK eVisa – A Guide for BRP/BRC Holders Expiring on 31 December 2024

As the UK border and immigration system is becoming ‘digital by default’ by 2025, traditional ink stamps and vignette visa stickers are being phased out. This transition means that BRP/BRC (Biometric Residence Permit/ Biometric Residence Card) holders with cards expiring on 31 December 2024 must create a UKVI account to access their eVisa.

However, many individuals are encountering an issue where their UKVI account shows the message “you have no recent applications.” If you’re facing this problem, here’s a step-by-step guide to help you resolve it and continue your registration process smoothly.

How to Fix “You Have No Recent Applications” Issue On UKVI Account

If your eVisa account shows “you have no recent applications”, please follow the steps below which should enable you to continue registering for your UKVI account:

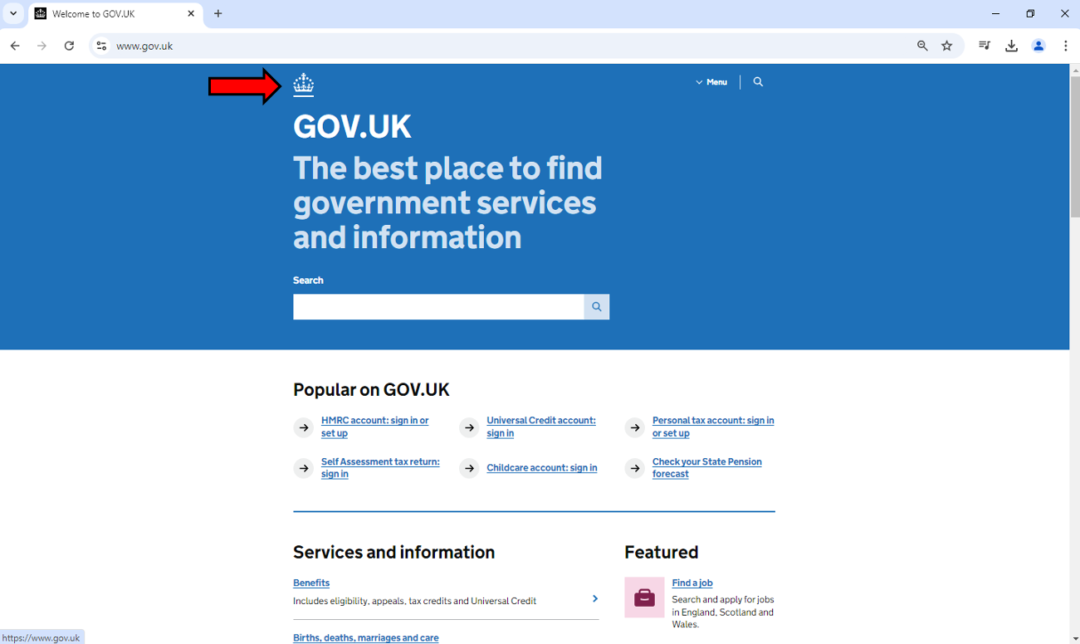

- Visit Gov.UK Welcome to GOV.UK (www.gov.uk)

- Click the Gov.UK icon (crown in the left-hand corner of the web page). This will refresh previous searches/history.

- Type eVisa into the search bar.

- Use the 2nd option listed ‘Get Access to your eVisa’

- Scroll down the page and click ‘Start Now’

- You will then be asked a few questions regarding your BRP and your passport

- There will then be two options ‘Create an account’ & ‘Sign in’ – Select ‘Sign In’ and you will be given the option to either continue to the GIDV app or be shown the form to complete. Follow the on-screen instructions to finish the registration process.

Why Is This Important?

As the UK government shifts towards a digital immigration system, it is crucial for BRP/BRC holders to understand and adapt to these changes. Failure to set up your UKVI account and access your eVisa could lead to difficulties in proving your immigration status, especially when traveling or interacting with public services in the UK.

IT Issues?

Transitioning to a digital system can be challenging, especially when dealing with unexpected technical issues. However, by following the steps outlined above, you can overcome the common “no recent applications” error and successfully access your eVisa. However, if you encounter further issues or have any concerns, don’t hesitate to seek professional guidance.

As an immigration lawyer, I am here to support you through these changes. Whether you need assistance with the eVisa process or have other immigration-related questions, feel free to reach out to me.

To discuss any of the points raised in this article, please contact Cheryl Ma or fill in the form below.

Managing Redundancies: What Employers Need to Know

In recent weeks, several prominent organisations have announced mass redundancies, underscoring the ongoing economic challenges faced by businesses. Dyson, the renowned technology company, recently revealed plans for up to 1,000 job cuts, citing shifts in market dynamics, and evolving business strategies. Similarly, Manchester United, one of the world’s most valuable football clubs, has made headlines with its own round of redundancies, reflecting broader financial pressures within the sports industry.

As these developments highlight the increasing prevalence of workforce reductions, it is crucial for employers to understand their legal obligations when it comes to handling redundancies. Failure to adhere to these requirements can result in significant financial, reputational and operational risks.

What Are Redundancies?

Essentially, redundancy occurs when an employer needs to reduce its workforce because a specific job role or a number of jobs are no longer required. Under the Employment Rights Act 1996, redundancy can arise in three types of situations, (1) business closure, (2) workplace closure, and (3) a diminished requirement of the business for employees to do work of a particular kind.

There are many different factors for which a business might need to consider making redundancies, for example, economic downturns, technological advancements or organisational restructuring.

It is also important to distinguish redundancy from other forms of dismissal. Unlike dismissals based on an employee’s performance or conduct, redundancy specifically relates to the role being redundant, not the individual. For instance, if a company introduces automation that replaces a particular job function, the role, not the person, becomes redundant. That said, performance or conduct could form part of the process for selecting which employees will be made redundant (more on this below).

What Must Employers Do?

Employers must follow several key principles to ensure that the redundancy process is legally compliant and fair. Failure to do so can lead to claims of unfair dismissal and other legal challenges.

Here are 5 key principles:

1. Genuine Redundancy Situation

Employers must demonstrate that the redundancy is legitimate, meaning that there is genuinely a reduced requirement for that role and there is a valid business reason for the decision. Common reasons include business closures, relocations, or a reduced need for specific roles.

An employer should have sufficient evidence to support the business reasons for proposing redundancies.

2. Meaningful Conversation

Consultation with employees is fundamental when assessing the fairness of any dismissal for redundancy. Therefore, failing to warn and consult with affected employees before dismissing them is very likely to be unfair.

Employers are required to engage in a meaningful consultation process with affected employees and where there are fewer than 20 redundancies, this should be conducted on an individual basis only. For 20 or more redundancies, see comments below. To ensure a proper consultation, it is important that employees are notified that they are at risk and informed of any redundancy proposals. This involves sharing relevant information, such as the reasons for redundancies, the number of employees affected, and the selection criteria. The consultation should allow employees to discuss the proposals and suggest alternatives.

There is no minimum period of time for a consultation to be meaningful or effective where less than 20 employees are concerned. The length of each consultation period should be determined on its own merits, ensuring it is sufficient to be considered meaningful and effective.

3. Fair Selection Process

The selection process for redundancy must be fair and transparent. Employers must identify the pool from which employees will be selected (if any), especially where employees perform the same or similar roles. Fair selection involves the fair application of objective and non-discriminatory selection criteria such as skills, qualifications, and length of service. Any bias or unfair treatment can result in legal claims.

4. Exploring Alternatives

Employers should consider suitable alternative employment to ensure that a fair and reasonable redundancy process has been followed. This may include offering alternative employment within the organisation, reducing working hours, or considering voluntary redundancies.

If, at the time of dismissal, an employer has failed to give consideration to whether suitable alternative employment existed in the business, it is likely an employee will argue their dismissal was unfair.

5. Statutory Redundancy Payment

Employees with two or more years of continuous service are entitled to statutory redundancy pay if they have been made redundant. The amount is calculated using a formula based on the employee’s age, length of service, and weekly earnings.

When Does Collective Consultation Apply?

If an employer proposes to make 20 or more employees redundant within a 90-day period, collective consultation rules apply. This is particularly relevant in cases like Manchester United, where the club’s new ownership plans to reduce staffing levels by 250 employees.

In such cases, employers must:

- Inform and consult with appropriate employee representatives of the affected employees as well as on an individual basis. An employer must first identify the affected employees and then consult with their employee representatives, such as trade unions or elected representatives. If there are no such representatives then an election process should be undertaken to nominate these representatives.

- Consult over a minimum period. The consultation must begin at least 30 days before the first dismissal takes effect if 20 to 99 employees are affected, or at least 45 days in advance if 100 or more employees are affected. An employment tribunal may award up to 90 days’ pay for each employee where an employer has breached its duty to inform and consult properly on a collective basis.

- Notify the Secretary of State on Form HR1. This is required where an employer is proposing to make more than 20 dismissals by reason of redundancy at one establishment within a 90-day period. The notification periods vary depending on whether the employer is proposing to make 100 or more dismissals or fewer than 100. Failure to provide the notification to the Secretary of State is a criminal offence and can result in significant penalties.

Conclusion

The recent redundancies at major organisations like Dyson and Manchester United are a stark reminder of the economic pressures businesses face today. For employers, it is crucial to understand the requirements of conducting a fair and transparent redundancy process and be prepared with the relevant information to ensure a meaningful process.

By understanding the key principles of redundancy and the requirements for collective consultation, businesses can manage these difficult decisions in a way that minimises disruption and upholds their legal responsibilities.

To discuss any of the points raised in this article, please contact Ramona Bakshi or fill in the form below.

Navigating and Assisting Family-Owned Businesses in Expanding to the UK Market

We regularly assist overseas companies in expanding their business in the UK and have observed that many of our APEC (Asia-Pacific Economic Cooperation) clients operate as family-owned businesses with a keen interest in the UK market. At Quastels LLP, we specialise in facilitating this transition, providing a wide range of comprehensive legal services, e.g. corporate, immigration, employment and tax planning, to ensure a seamless and successful expansion.

Why Choose The UK As Your Business Centre In Europe?

The UK is an attractive destination for APEC family-owned businesses seeking to establish a presence in Europe. Its strategic location, which offers easy access to European markets, making it an ideal hub for international operations. The UK boasts a stable political environment, a strong legal system, and a pro-business regulatory framework that fosters growth and innovation. Expanding into the UK also allows the businesses to diversify their operations geographically, reducing reliance on their home markets.

Setting Up Your UK Presence

Establishing a presence in the UK requires careful planning and expert legal guidance. At Quastels, we assist with every step of the process, starting with choosing the most suitable business structure, whether it be a branch office, subsidiary, or joint venture. We handle all aspects of company formation, from registration with Companies House to drafting Articles of Association, ensuring compliance with UK corporate governance standards. Navigating the UK’s regulatory environment can be complex, but our team is well-versed in all legal requirements including industry-specific regulations.

Relocating Overseas Core Members

When expanding a family-owned business to the UK, it is crucial to address immigration matters well in advance of the incorporation process. Properly planning the relocation of key personnel, such as overseas directors, senior members or successors, is vital for ensuring a smooth transition and successful business expansion in the UK. The choice of visa options can significantly influence the structure and operations of your business. We specialise in developing tailored immigration strategies that align with your business objectives, streamlining the relocation process.

Our expert team will guide you through the complexities of the UK’s immigration system, helping secure the most suitable visas for your core team members. Whether your needs involve Skilled Worker visas, Expansion Worker visas, or Senior or Specialist Worker visas, we will support you in obtaining the necessary sponsor licenses. Additionally, we offer comprehensive compliance training services to ensure your business remains fully compliant with UK immigration laws. Our ongoing support extends to visa renewals and compliance audits, safeguarding your business against potential legal challenges and ensuring long-term success in the UK market.

Pre-Arrival Tax Planning

When expanding your family business to the UK, effective personal tax planning is essential to optimise your financial position and ensure compliance with UK tax laws. Our law firm offers comprehensive personal tax planning services tailored to the unique needs of family-owned businesses, helping you navigate the complexities of the UK tax system as you establish and grow your presence in the country, and assist you protect your family’s wealth across generations.

Supporting Business Operations

Once your business is established in the UK, ongoing legal support is crucial to ensure smooth operations. We could provide assistance with regulatory compliance, employment law, commercial dispute resolution and sector-specific legal requirements. Additionally, we provide continuous advisory services on business expansion, mergers, and acquisitions, ensuring your business is well-positioned for growth and success in the UK market.

At Quastels, we understand the diverse cultures and business practices across the APEC region, that the family-owned business often have a long-term focus, strong family values, and a desire to preserve and grow wealth across generations. Our firm is experienced in addressing these specific concerns, ensuring that your family’s legacy is protected as you expand into new markets. By partnering with us, you gain a trusted advisor dedicated to your long-term success.

If you or your connections require legal advice, please contact Lin Li or fill out our enquiry form below.