Latest Posts

Selling Smarter: Conveyancing Tips for a Smoother Property Sale

The process of selling your home can be stressful, but with the right approach, it does not have to be. From gaining a good understanding of what to expect to preparing key documents early, these conveyancing tips will help streamline the process, avoid delays and ensure a smoother, more efficient sale from start to finish.

Understanding the Conveyancing Process

Once you instruct your conveyancer and complete the property information forms, they send a contract pack to the buyer’s conveyancer. For leasehold properties, a management pack is also ordered which contains information on management, fees and obligations.

The buyer’s conveyancer conducts searches, surveys and may raise enquiries. Your conveyancer will help respond to these with your consultation, where appropriate.

Once all enquiries are satisfied, both parties exchange contracts and set a completion date. Exchange makes the sale legally binding.

On completion, the buyer’s conveyancer transfers funds, you vacate the property and then hand over the keys. Any existing mortgage is redeemed, and the sale proceeds are sent to you.

Document Provision and Upfront Information

Providing upfront information to your conveyancer allows them to prepare a comprehensive contract pack, identify potential issues and speed up the process.

Although property owners might not have complete records of their documents, providing as much as possible early on makes your property more appealing to buyers.

We recommend you start compiling your property documents when you list the property, to make things easier once a sale is agreed.

At the outset, you will need to provide your proof of identity and address, onboarding documents, and Land Registry Forms:

- Property Information Form (TA6) – discloses key details about the property.

- Fittings and Contents Form (TA10) – Lists items at the property to be included/excluded in the sale.

- Leasehold Information Form (TA7) – Relevant if the property is leasehold.

You should also consider if the following items are relevant to your sale:

- Your mortgage details, so your conveyancer can arrange repayment on completion.

- Newbuild home warranty (i.e. NHBC, LABC, Premier or other providers).

- Planning Permissions, consents and building regulation certificates – for alterations or major works.

- Gas Safety and Electrical Certificates – If available, especially for recent works.

- Warranties and Guarantees – For windows, boilers, etc.

- Dispute and Insurance Claim details.

- Indemnity policies taken out when you purchased the property.

If requires, complete, sign, and serve the Leaseholder Deed of Certificate promptly, as your landlord has 4 weeks to respond.

Communication with your Conveyancer

Effective communication between you and your conveyancer will ensure the smooth and swift progression of your sale. It also helps your conveyancer manage progress towards known deadlines, keeping all parties aligned.

Agree on the best way to communicate with your conveyancer early on. Email will be the primary form of communication throughout the transaction, but notify them if you wish to use alternatives, when appropriate. For example, the best way to reach you for urgent matters, or perhaps you would like time-sensitive updates via WhatsApp.

Quick, clear contact helps resolve issues faster, reduces stress, and lowers the risk of delays or the sale falling through.

Following these conveyancing tips will help ensure a smooth sale. For more information, please contact our Residential Real Estate team via the form below.

Read More

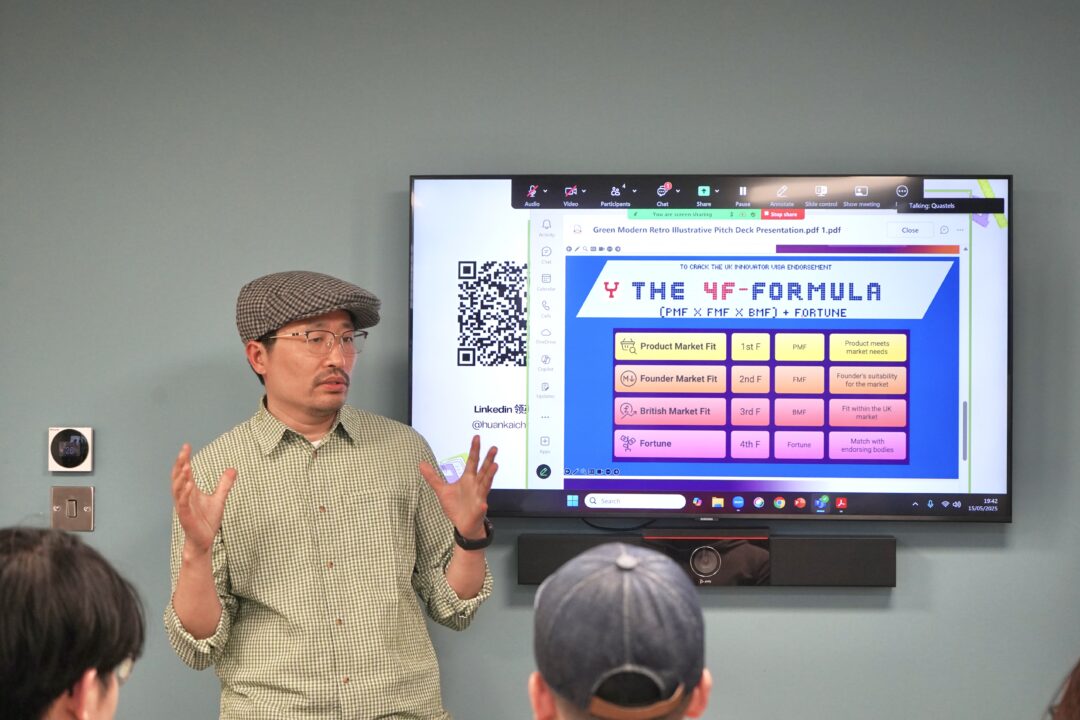

Quastels Hosts Monthly APAC Networking Events in Collaboration with NEXTidal

Quastels is proud to host a series of monthly networking events through its APAC Desk, in collaboration with NEXTidal, a community-driven initiative that connects Chinese entrepreneurs and investors with opportunities in the UK. Spearheaded by Senior Associate Lin Li, these event’s reflect our firm’s ongoing commitment to supporting cross-border business ventures and fostering meaningful professional relationships.

Strengthening the APAC-UK Business Bridge

Our monthly networking sessions serve as a dynamic platform for entrepreneurs, founders, and investors to share insights, discuss business strategies, and explore collaborative opportunities. These events are designed to cultivate a supportive ecosystem for Chinese entrepreneurs navigating the UK market, offering a valuable space to connect with like-minded professionals and industry leaders.

Quastels and NEXTidal work closely to ensure each event offers real value to attendees. The format typically includes introductions to both organisations, a spotlight on our APAC Desk’s legal capabilities, and a presentation by a guest speaker, a Chinese entrepreneur or founder who has successfully launched their business in the UK. Following the presentation, guests engage in open networking sessions, creating opportunities for new partnerships, mentorships, and investment discussions.

What is NEXTidal?

NEXTidal is an initiative that brings together entrepreneurs, investors and seasoned professionals to foster innovation and international growth. Their mission is to support both established Chinese brands looking to expand internationally and new start-ups founded by Chinese entrepreneurs in the UK.

Through networking events, strategic partnerships, and curated resources, NEXTidal plays a pivotal role in connecting Chinese-founded businesses with the support systems they need to thrive abroad, from funding opportunities to expert-led advice on navigating local markets.

The Role of Quastels’ APAC Desk

As a trusted legal partner to NEXTidal, Quastels provides end-to-end support to emerging and expanding businesses operating between Asia and the UK. Our APAC Desk, led by legal professionals with deep regional expertise & language capabilities, delivers tailored legal guidance in areas such as market entry strategies, corporate structuring, commercial agreements, employment law, and mergers & acquisitions.

We understand the regulatory and cultural complexities that come with international business expansion. Our team helps clients navigate these challenges with confidence, combining legal acumen with a strategic understanding of the business environment across both regions. Whether it’s structuring a joint venture, drafting cross-border commercial contracts, or ensuring compliance with UK regulatory requirements, we support our clients every step of the way.

A Glimpse Into the Events

The APAC networking events take place at our centrally located Baker Street office in London, with a hybrid option for virtual attendance. This flexible format enables wider participation and facilitates connections across geographies.

Each month, we feature a new guest speaker, an entrepreneur of Chinese origin who is actively building a presence in the UK. These speakers have represented a wide spectrum of industries, including pet care innovation, live music and entertainment, and artificial intelligence solutions. Their stories highlight the creativity, resilience, and ambition that define the modern entrepreneurial journey.

These events don’t just showcase success stories. They also serve as a forum for open dialogues about challenges, lessons learned, and how communities like NEXTidal and legal partners like Quastels can offer meaningful support.

Looking Ahead

As the global business landscape becomes increasingly interconnected, Quastels remains committed to building bridges between regions and empowering entrepreneurs to think beyond borders. Our ongoing collaboration with NEXTidal is more than a professional partnership. It’s a shared vision for fostering innovation, collaboration, and sustainable growth across international markets.

We welcome founders, investors, and professionals who are interested in engaging with the APAC-UK corridor to join us at our upcoming events. Whether you are in the early stages of expanding your business or seeking new connections in the UK market, these sessions are an ideal opportunity to gain insight, forge partnerships, and access specialist legal expertise tailored to your international ambitions.

For more information about our APAC Desk or upcoming events, please contact us either by completing the form below, or emailing lli@quastels.com.

Read More

Turning the Tide: How We Overturned a Visa Refusal Due to Criminal Convictions

Applying for a UK visa can be a challenging process, particularly when an applicant has a history of criminal charges. In a recent case, I successfully overturned a visa refusal based on criminal grounds, securing my client’s right to enter the UK despite significant legal obstacles. This case highlights the power of a well-structured legal argument and strategic advocacy in overcoming complex immigration barriers.

Background

My client applied for a UK visa but was refused due to previous criminal convictions. The Home Office assessed that their criminal history posed a risk to public safety and deemed their presence in the UK ‘conducive to the public good’.

With six past charges, including robbery, drug possession, and theft, my client’s application was refused under paragraph 9.4.1 of the Immigration Rules, which states that an application ‘must’ be refused if an applicant:

(a) has been convicted of a criminal offence in the UK or overseas for which they have received a custodial sentence of 12 months or more; or

(b) is a persistent offender who shows a particular disregard for the law; or

(c) has committed a criminal offence, or offences, which caused serious harm.

The refusal was based on (b) and (c), with the Home Office asserting that my client was a persistent offender and that their offences had caused serious harm.

Key Challenges

One of the main hurdles in this case was contesting the Home Office’s classification of my client’s past conduct as ‘serious harm’ and establishing that they were not a persistent offender at the time of application. The Refusal Letter stated that:

“where a person has been convicted of one or more violent, drugs-related, racially motivated, or sexual offences, they will normally be considered to have been convicted of an offence that has caused serious harm.”

Although my client’s convictions were more than a decade old, UK immigration law does not impose a time limit on considering past criminality in visa applications. This is in contrast to naturalisation applications, where most offences are disregarded after ten years. Given this, it was essential to challenge the Home Office’s interpretation of my client’s past offences and establish that they no longer posed a risk to the public.

My Strategic Legal Approach

To overturn the refusal, I pursued an Administrative Review, adopting a multi-faceted approach:

- Critical Review of the Decision – I conducted a detailed analysis of the refusal letter, identifying gaps, inconsistencies and weaknesses in the Home Office’s reasoning.

- Legal Argumentation – Highlighting Key Errors:

- Unsubstantiated Serious Harm Claim– The Home Office’s assertion was unsupported by evidence and should not have been a decisive factor in the refusal.

- Disproportionate Conclusions– The circumstances of the case did not support the claim that the offence had a widespread harmful impact.

- Misapplication of the ‘persistent offender’ standard– The Home Office incorrectly referenced past convictions without considering whether a pattern of offending still existed at the time of application.

- Sentencing guidelines– A careful review of sentencing precedents showed that my client’s offences did not meet the threshold for serious harm in the immigration law context.

- Case Law Precedents– I cited relevant legal precedents to demonstrate that not all violent or drug-related offences automatically meet the threshold of serious harm.

- Demonstrating Rehabilitation– To reinforce my client’s case, I presented substantial evidence, including character references, employment history, and proof of community engagement, to establish that my client had reformed.

By structuring the Administrative Review in this way, I demonstrated that the refusal was based on outdated and disproportionate reasoning and that my client posed no ongoing risk to public safety.

The Outcome

Following a well-evidenced and persuasive challenge, the Home Office overturned the visa refusal. My client was granted permission to enter the UK, allowing them to work and rebuild their life – a result that would have been unattainable without strategic legal intervention.

Key Takeaways

This case underscores the importance of:

- Challenging visa refusals through Administrative Review when decisions are unfair.

- Building a compelling legal argument based on proportionality and fairness.

- Challenging misinterpretations of serious harm and persistent offending.

- Presenting strong evidence of rehabilitation to counter past convictions.

Overturning a visa refusal based on criminality is a highly complex process that requires precise legal arguments, in-depth case law research, and compelling evidence. Every detail matters. While the above outlines key elements of our strategy, success in such cases depends on addressing a range of intricate legal and evidentiary challenges tailored to the specific circumstances of each client.

With the right legal representation, many refusals can be successfully overturned. If you or someone you know has been denied a UK visa due to past conviction, my team and I are here to help. Contact us today to discuss your case and explore your options for appeal.

Read More