Latest Posts

Selling Smarter: Conveyancing Tips for a Smoother Property Sale

The process of selling your home can be stressful, but with the right approach, it does not have to be. From gaining a good understanding of what to expect to preparing key documents early, these conveyancing tips will help streamline the process, avoid delays and ensure a smoother, more efficient sale from start to finish.

Understanding the Conveyancing Process

Once you instruct your conveyancer and complete the property information forms, they send a contract pack to the buyer’s conveyancer. For leasehold properties, a management pack is also ordered which contains information on management, fees and obligations.

The buyer’s conveyancer conducts searches, surveys and may raise enquiries. Your conveyancer will help respond to these with your consultation, where appropriate.

Once all enquiries are satisfied, both parties exchange contracts and set a completion date. Exchange makes the sale legally binding.

On completion, the buyer’s conveyancer transfers funds, you vacate the property and then hand over the keys. Any existing mortgage is redeemed, and the sale proceeds are sent to you.

Document Provision and Upfront Information

Providing upfront information to your conveyancer allows them to prepare a comprehensive contract pack, identify potential issues and speed up the process.

Although property owners might not have complete records of their documents, providing as much as possible early on makes your property more appealing to buyers.

We recommend you start compiling your property documents when you list the property, to make things easier once a sale is agreed.

At the outset, you will need to provide your proof of identity and address, onboarding documents, and Land Registry Forms:

- Property Information Form (TA6) – discloses key details about the property.

- Fittings and Contents Form (TA10) – Lists items at the property to be included/excluded in the sale.

- Leasehold Information Form (TA7) – Relevant if the property is leasehold.

You should also consider if the following items are relevant to your sale:

- Your mortgage details, so your conveyancer can arrange repayment on completion.

- Newbuild home warranty (i.e. NHBC, LABC, Premier or other providers).

- Planning Permissions, consents and building regulation certificates – for alterations or major works.

- Gas Safety and Electrical Certificates – If available, especially for recent works.

- Warranties and Guarantees – For windows, boilers, etc.

- Dispute and Insurance Claim details.

- Indemnity policies taken out when you purchased the property.

If requires, complete, sign, and serve the Leaseholder Deed of Certificate promptly, as your landlord has 4 weeks to respond.

Communication with your Conveyancer

Effective communication between you and your conveyancer will ensure the smooth and swift progression of your sale. It also helps your conveyancer manage progress towards known deadlines, keeping all parties aligned.

Agree on the best way to communicate with your conveyancer early on. Email will be the primary form of communication throughout the transaction, but notify them if you wish to use alternatives, when appropriate. For example, the best way to reach you for urgent matters, or perhaps you would like time-sensitive updates via WhatsApp.

Quick, clear contact helps resolve issues faster, reduces stress, and lowers the risk of delays or the sale falling through.

Following these conveyancing tips will help ensure a smooth sale. For more information, please contact our Residential Real Estate team via the form below.

Read More

An 8-Step Guide to the Conveyancing Process for Buyers

For first-time buyers and seasoned property owners, the conveyancing process can be rather daunting and complex. This 8-step guide to the conveyancing process explains the key steps of purchasing a property, from instructing a solicitor, through to completion.

Step 1: Instructing a Solicitor

a) Once your offer has been accepted on a property, your first step is to instruct a property solicitor. Choosing the right solicitor is essential for a smooth, stress-free transaction.

b) When making your decision, you may wish to consider several factors such as online reviews, whether the solicitor is fully qualified, and if the firm is on your mortgage lender’s panel. It can also be beneficial to choose a local firm familiar with the area’s property market.

c) Capacity, timescales, and whether the solicitor is part of the Law Society Conveyancing Quality Scheme (CQS) are also important considerations. CQS accreditation demonstrates a firm’s ability to provide residential conveyancing advice to the standards expected by clients, lenders, and the residential conveyancing community. At Quastels, we are proud to have secured membership to the Law Society’s Conveyancing Quality Scheme.

d) Once you have chosen your solicitor, the firm will provide you with a cost estimate. Upon agreement, you will receive a confirmation letter along with documents to sign, officially instructing them to begin the legal process. Your solicitor will request identification documents, proof of funds, and money on account to cover third-party disbursements such as property searches.

Step 2: Arranging a Mortgage (if required)

a) If you require a mortgage, you should apply for this once your offer is accepted.

b) You can arrange this directly with a bank, building society, or through a mortgage broker. Many buyers opt for a broker to help streamline the process by comparing options across the market.

c) Once you receive your mortgage offer, you must provide a copy to your solicitor so they can ensure all lender requirements are satisfied.

Step 3: Property Survey

a) When purchasing a property, the principle of “buyer beware” applies. This means that you are responsible for identifying any potential issues with the property’s condition. A solicitor cannot advise on the physical aspects of the property, as they do not physically inspect the property.

b) A survey is not mandatory, but it can provide valuable insight into the property’s condition. Surveys range in cost from around £350 to £2,000 and typically take between two and four weeks.

c) Conducted by a professional chartered surveyor, a survey highlights structural issues or necessary repairs. If any concerns arise, you may wish to obtain specialist quotes for repairs and use this information to renegotiate the purchase price if necessary. For example, if the property needs an electrical rewire which is going to coast £4,000, you may wish to consider asking the seller to reduce the price of the property accordingly.

Step 4: Property Searches

Property searches are enquiries with public authorities to give you more information about the property you intend to buy. A variety of searches may be required, but the mandatory searches you must obtain if you require a mortgage include:

- Local Authority Search– Provides details about planning permissions, building regulations, conservation areas, road access, and any enforcement notices affecting the property.

- Environmental Search– Reveals environmental risks such as flooding, ground subsidence, contamination, energy, and nearby infrastructure projects.

- Water and Drainage Search– Confirms whether the property is connected to mains water and drainage.

Step 5: Preparing for Exchange of Contracts

a) Once your solicitor receives your search results, survey, mortgage offer, and all relevant sale documents from the seller, they will prepare a ‘Report on Title.’ This report summarises the key legal details of the property, the contract, the lease (if applicable), and the search results. Your solicitor will highlight any areas of concern.

b) Once you are satisfied with the report, you will be asked to sign the contract and transfer the deposit, which is typically 10% of the purchase price unless otherwise agreed.

c) Both you and the seller will agree on a completion date.

Step 6: Exchange of Contracts

a) Your solicitor will proceed to exchange of contracts, once they hold your 10% deposit, signed contract, mortgage offer (if applicable) and instructions from you to proceed.

b) On exchange of contracts, the completion date is agreed and the contract becomes legally binding.

c) Your solicitor will request the mortgage advance (if applicable) in good time for completion.

d) Your solicitor will prepare a final completion statement and invoice showing the total funds required for completion, including Stamp Duty Land Tax, legal fees, Land Registry fees, and the balance of the purchase price.

Step 7: Completion

a) On the completion date, your solicitor will transfer the purchase funds to the seller’s solicitor.

b) The seller’s solicitor will then redeem any outstanding mortgage, pay the estate agent and their own legal fees, and transfer the balance to the seller.

c) Once funds are received, the seller’s solicitor will authorise the release of the keys, which can be collected from the estate agent.

Step 8: Post-Completion

a) Following completion, your solicitor will submit an application to the Land Registry to register the property in your name.

b) Once registration is complete, the Land Registry will update the title into your name reflecting your ownership.

c) Your solicitor will also arrange the submission of your Stamp Duty Land Tax payment to HMRC.

d) If the property is leasehold, a Notice of Transfer will be served on the landlord or managing agent to officially update you as the new owner.

If you require conveyancing services, please complete the form below to get in touch with our Residential Real Estate team.

Read More

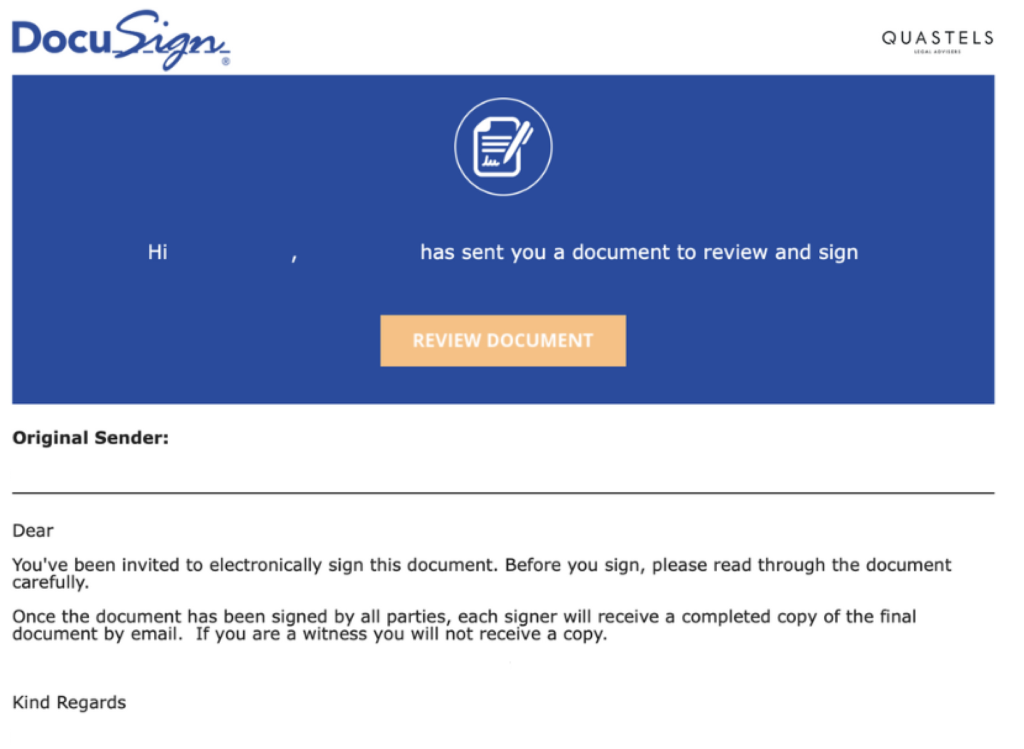

Docusign | How-To Guide

During the conveyancing process, your solicitor/conveyancing executive will ask you to sign a document(s) using Docusign. Below is a simple guide that takes you through the stages of setting up a witness and electronically signing the document(s).

1. Client Receives Email From Docusign (/Infotrack)

Your solicitor/conveyancing executive will set up the signature request, and you will receive an email from Docusign titled ‘Request for Witness Details.’

Please ensure to read the email in full to understand the witness nomination rules, and how to carry out your signing as swiftly and efficiently as possible. All parties involved in the transaction will be sent separate emails with invitations to sign (e.g. a husband and wife purchasing a property together will have to complete this process individually, via the invitations sent to their respective email addresses).

2. Start Signing Process

Click the blue ‘Start Now’ button at the bottom of the Docusign email.

3. Nominate A Witness

In order to sign, you must nominate a witness. All parties can use the same witness however, the witness must be in the physical presence of the signees, must not be related to the signee(s) (for example, your mother/father in law could not be a witness), the witness must also be over 18, and must not be partied to the transaction in any way (ie. giftor).

4. Enter Witness Details and Sign

Enter all required witness details on the left-hand side and once all details have been correctly entered, select the orange ‘Nominate Witness’ button. Once you have successfully appointed your witness, you will be able to proceed with signing the relevant documents. When signing has been completed, please select ‘Finish.’

5. Witness Signs the Documents

At this point, your witness will receive an email from Docusign inviting them to confirm that they witnessed the parties signing. The witness must click the ‘Review Document’ button on the email (you might need to ‘download external images’ in order to see and click this button).

Your witness will need to authenticate their telephone number. Once that is done, the witness will be able to open the document, to confirm T&Cs, and select ‘Continue.’

The witness must then select the ‘Sign’ tab to finalise your signature.

Once all information has been auto-filled, please select the ‘Finish’ button at the top of the page.

Please note, In order for your solicitor to receive the final and completed documents, all parties involved in the transaction and witnesses must have completed all tasks.

6. Signatures Complete

Once all parties have signed, your solicitor will receive a copy of the completed documents.

If you have any queries during this process, please do get in touch with your solicitor or conveyancing executive.

If you require legal assistance for the purchase or sale of a property, please contact our Residential Real Estate team.

Read More