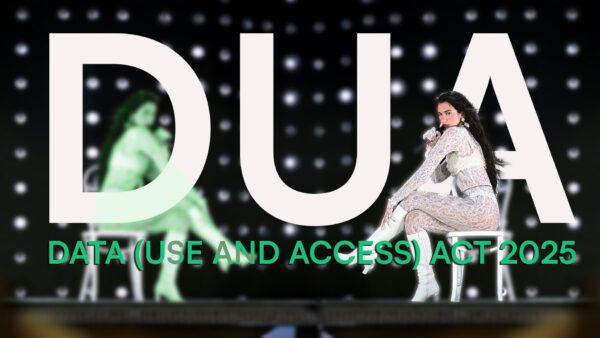

The global wealth landscape is experiencing some earth-shattering shifts in 2024, as revealed by the latest millionaire migration data (see below). Behind this trend, highlighting the significant migration and movement of high-net-worth individuals (HNWIs), is an intriguing insight into the economic and social factors influencing such movement. Concerning for many closer to home and one of the most stand-out aspects of this data is the considerable exodus of wealthy individuals from the UK.

What Is Causing The Exodus?

In short, the UK is projected to see a net loss of 9,500 millionaires in calendar year 2024, making it one of the top countries experiencing an outflow of affluent residents. Several factors appear to contribute to this migration, including:

- Perceived political instability – although arguably few ‘developed’ nations are entirely immune from this currently (noting France and the US to name a few);

- Economic uncertainty post-Brexit;

- High tax rates and the prospect for ever greater tax rises under an incoming Labour Government, noting the proposal to abolish the ‘non-dom’ regime by both the Conservative and Labour Parties; and

- Perhaps more compellingly, the allure of more stable, tax favourable environments in other jurisdictions, such as Italy, UAE and Switzerland.

For example, jurisdictions like the UAE, with a net influx of 6,700 millionaires, and even the US despite being caught up in potential turbulence with the upcoming presidential election, attracting 3,800, are becoming popular destinations due to their perceived favourable tax regimes and economic opportunities.

I’m Thinking of Leaving – What Do I Do?

Whatever the case may be, migration presents many opportunities as well as many potential pitfalls. For anyone considering such a move, it is essential to understand the complexities involved, particularly when it comes to taxes. When leaving, perhaps predictably so, the focus tends to be on the arrival lounge rather than the departure lounge. Put differently, where the grass appears greener, human attention will follow. However, leaving a country without proper tax advice can lead to unexpected liabilities and headaches. Indeed, leaving may not necessarily mean a total severance with no return as, after many years of residence, it is so easy to say goodbye for good.

So, a key part of relocating is understanding the tax implications in both places. In the UK, for instance, the tax system is residence-based, meaning some might still owe UK taxes even after moving abroad. The nuances of double taxation agreements between the UK and the destination country can also impact the fiscally-felt future lying ahead. So, getting comprehensive tax advice isn’t just a good idea—it’s a must.

Tax aside, the relocation of millionaires can impact the economies of both the countries of departure and arrival. In the UK, losing high-net-worth individuals could affect investment levels, job creation, and overall economic dynamism. On the other hand, countries attracting these wealthy migrants stand to gain significantly, with potential boosts in investment, economic activity, and the prime property market.

Some Parting Advice

Put simply, the millionaire migration trend of 2024 highlights the importance of stability, economic opportunity, and favourable tax policies in retaining and attracting HNWIs to various jurisdictions. As the global wealth landscape continues to evolve, understanding these trends will be crucial for navigating the opportunities and challenges ahead. As ever, contact your friendly tax advisor to understand how such moves might impact you.

For private wealth & tax advice and services, please contact Ben Rosen via our contact form below.